Cash flow stream calculator

To include an initial investment at time 0 use Net Present Value NPV Calculator. Cash flow series PV - Total present value after combining all the cash flows from each period.

Present Value Of A Mixed Stream Cash Flow Accounting Hub

Where is time remaining until cash flow.

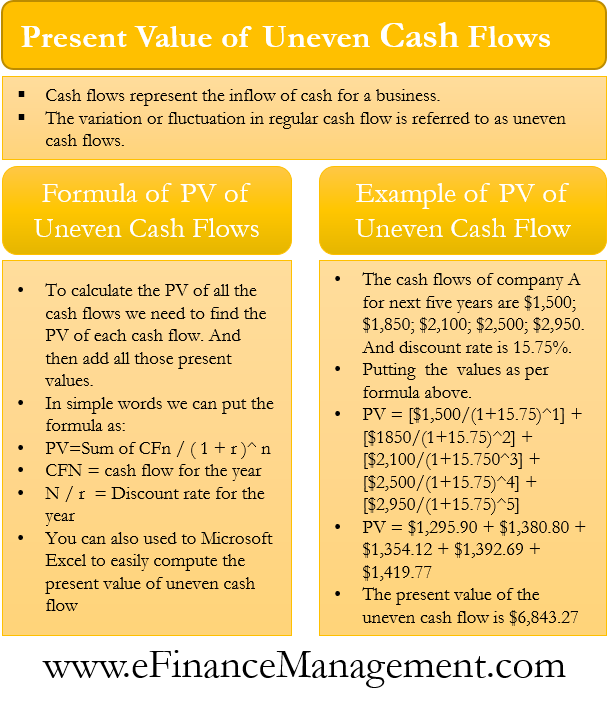

. More specifically you can calculate the present value of uneven cash flows or even cash flows. Commonly a period is a year or month. DCF analyses use future free cash flow projections and discounts them using a.

73 means youll receive 73 for every 10 you. Our tools and calculators can help you to better understand how XTBs can provide a regular income stream and improved capital stability. The other cash flows will need to be discounted by the number of years associated with each cash flow.

Cash flow is crucial for any business. Explore your retirement income stream by using our retirement income calculator. Get 247 customer support help when you place a homework help service order with us.

A great rental property calculator takes the guesswork out of forecasting your cash flow and makes it much easier to grow a profitable portfolio. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 1-in-100 flood a flood with 1 in 100 chance of occurring in any given year used as a safety requirement for the construction industry.

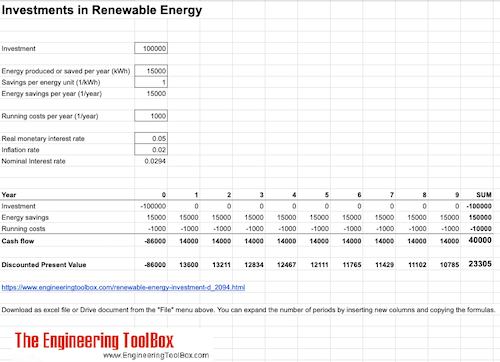

Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time. Calculate Cash Flows Use our unique calculator to map your bond cash flows. How to calculate discounted net present value in a typical renewable energy project.

Heres what you need to know about them. Thus for a stream of cash flows fu ending by time T. This page shows a list of stories andor poems that this author has published on Literotica.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Explore your retirement income stream by using our retirement income calculator. A financial model for rental property that you can stand behind.

Investors may wonder what the cash flow. Home financial present value calculator. Passive income is all the rage.

Football decimal odds are easy to understand because they represent the payout youll get if you win eg. Free financial calculator to find the present value of a future amount or a stream of annuity payments. Income statements balance sheets and cash flow statements are important financial documents for all businesses.

They have risen tenfold since then but at 2237 they remain a long-term buy. Periods This is the frequency of the corresponding cash flow. Calculate the net present value NPV of a series of future cash flowsMore specifically you can calculate the present value of uneven cash flows or even cash flows.

A home equity loan is a consumer loan allowing. The amount of cash or cash-equivalent which the company receives or gives out by the way of payments to creditors is known as cash flow. The most important factor that has an impact on present value is interest or.

Youre going to want to maintain a cash stream for day-to-day operations. In this article Im going to give you one of the most important tools in any real estate investors toolbox. Significant improvement for income cash flow type.

An MMM-Recommended Bonus as of August 2021. 6 to 30 characters long. It gives a snapshot of the amount of cash coming into the business from where and amount flowing out.

Cash flow analysis is often used to analyse the liquidity position of the company. The water quality standard for greywater use in toilets laundry and surface irrigation. ASCII characters only characters found on a standard US keyboard.

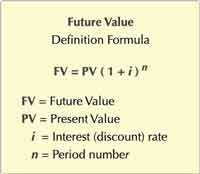

Factors that impact Present value calculations Rate of return. Understanding Football Betting Odds. Interest Rate discount rate per period.

5Rs - sustainability reduce. Including cash savings brokerage IRAs 401ks and any other assets you plan to use for retirement income. Must contain at least 4 different symbols.

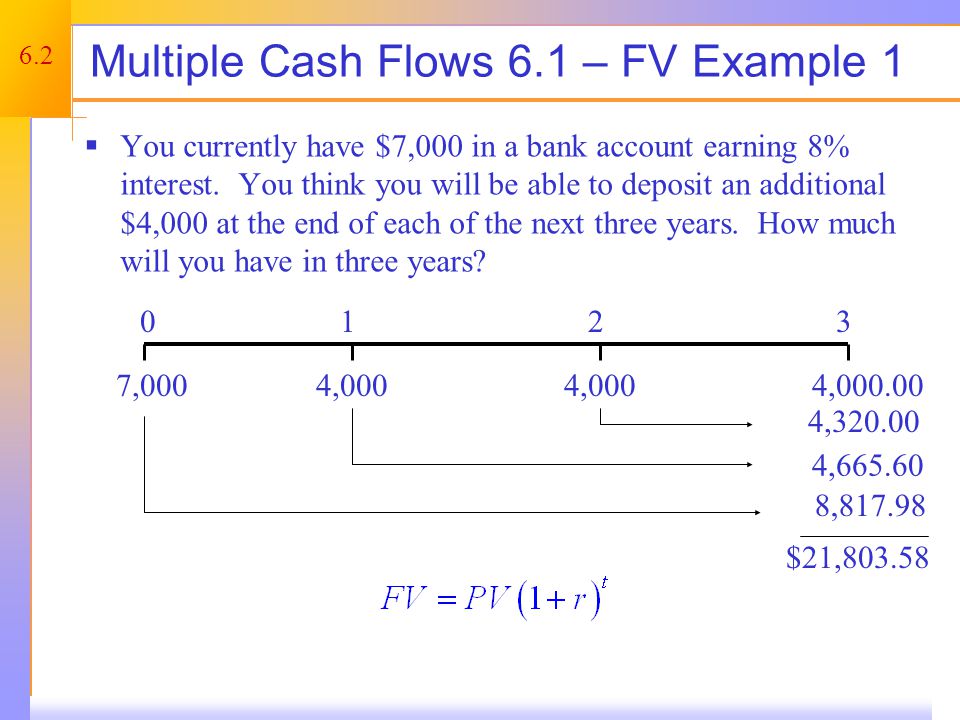

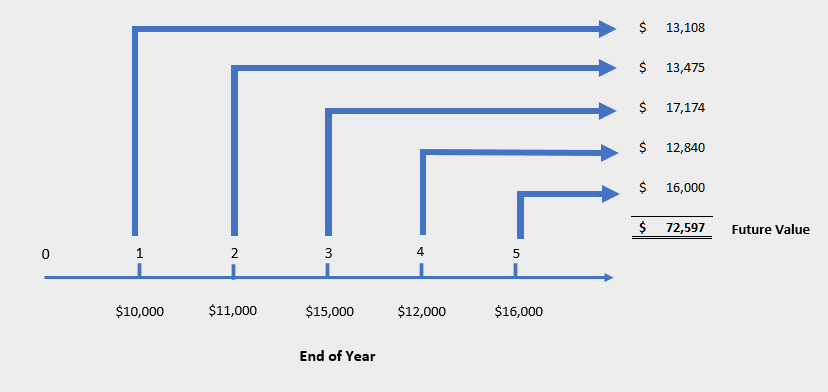

The calculator below can be used to estimate Net Present Wort - NPW - in an investment project with up to 20 periods and variable cash flows. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. We discount our cash flow earned in Year 1 once our cash flow earned in Year 2 twice and our cash flow earned in Year 3 thrice.

Heres how you can earn some extra cash without leaving the comfort of your home. Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity. PMT or periodic payment is an inflow or outflow amount that occurs at each period of a financial stream.

Get 247 customer support help when you place a homework help service order with us. Example - Investment In Renewable Energy - Discounted Cash Flow. We show Football betting odds on the Exchange in decimals.

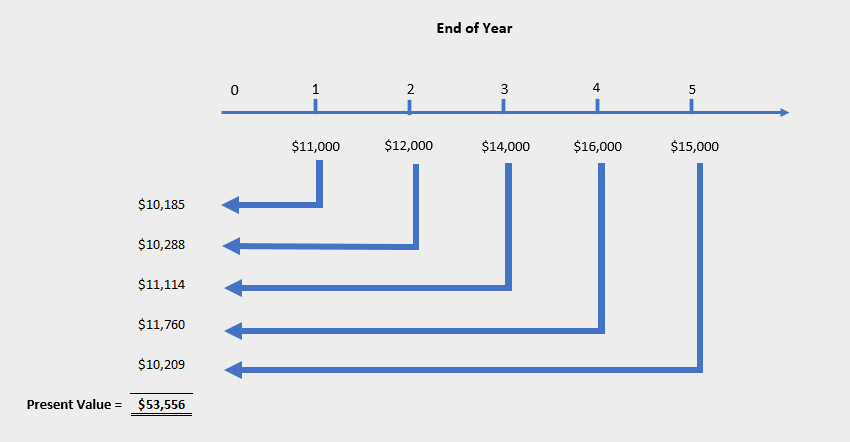

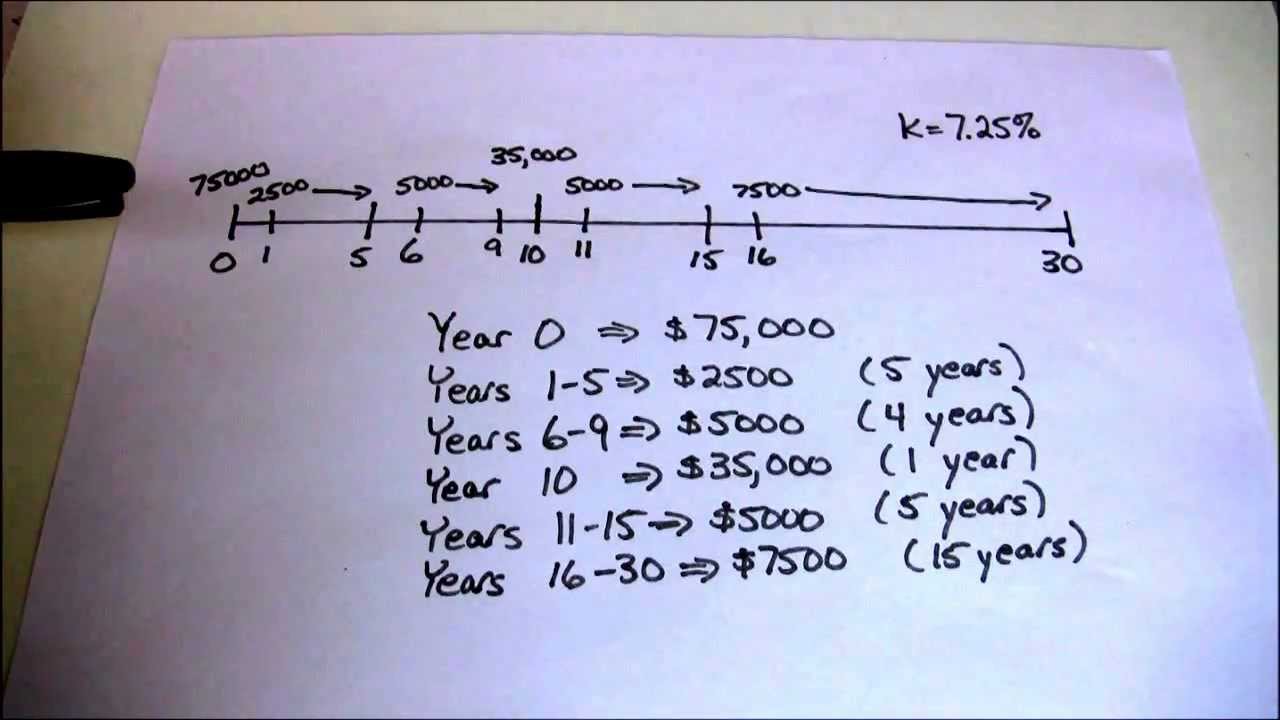

Cash flow stream - This will show you the present value of each period against the future cash flows. The solutions may be found using in most cases the formulas a financial calculator or a spreadsheet. Learn how you can impact how much money you could have each month.

The formulas are programmed into most financial calculators and several spreadsheet functions such as PV FV RATE NPER and PMT. 203010 standard - 20 mgl Biochemical Oxygen Demand BOD 30 mgl Suspended Solids SS 10 units of E. When Periodic Withdrawal Amount is Unknown and Annual Inflation Rate does not equal 0 the calculator will calculate an inflation adjusted cash flow that lasts as long as the value entered for Number of Cash Flows This means the initial withdrawal will be less than if there were no inflation adjustment.

Heres how you can take advantage in 2022. Net Present Worth Calculator - Variable Cash Flow Stream. The difference between the two is that while PV represents the present value of a sum of money or cash flow NPV represents the net of all cash inflows and all cash outflows similar to how the.

Midas first recommended the shares in 2008 at 206. See Present Value Cash Flows Calculator for related formulas and calculations. Take for instance a rental property that brings in rental income of 1000 per month a recurring cash flow.

Solving For Fv Of Uneven Cash Flows Using Baii Plus Youtube

Uneven Cash Flow Streams On The Ti 83 Or Ti 84 Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Present Value Of Cash Flows Calculator

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Chapter Outline Future And Present Values Of Multiple Cash Flows Ppt Video Online Download

Present Value Of Uneven Cash Flows All You Need To Know

2022 Cfa Level I Exam Cfa Study Preparation

Net Present Worth Npw Of A Cash Stream

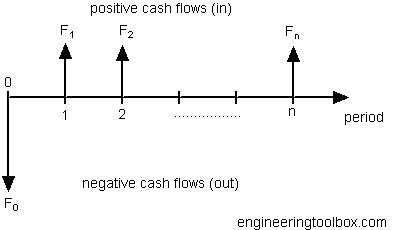

Cash Flow Diagrams

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Calculate The Future Value Fv Of Uneven Cash Flows On Excel Two Methods Youtube

How To Use Discounted Cash Flow Time Value Of Money Concepts

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Uneven Cash Flow Streams On The Hp10bii Youtube

Future Value Of A Mixed Stream Cash Flow Accounting Hub

Future Value Of Cash Flow Stream After Finding Pv 4 1 4 Youtube